Competitive pricing on online markets: a literature review

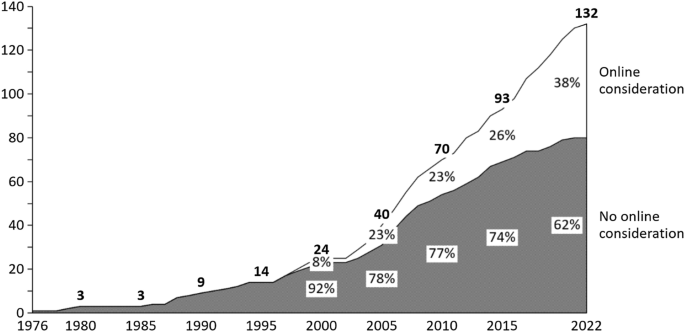

Past reviews of studies concerning competitive pricing strategies lack a unifying approach to interdisciplinarily structure research across economics, marketing management, and operations. This academic void is especially unfortunate for online markets as they show much higher competitive dynamics compared to their offline counterparts. We review 132 articles on competitive posted goods pricing on either e-tail markets or markets in general. Our main contributions are (1) to develop an interdisciplinary framework structuring scholarly work on competitive pricing models and (2) to analyze in how far research on offline markets applies to online retail markets.

Similar content being viewed by others

Pricing Strategies in the Electronic Marketplace

Chapter © 2014

Can Online Retailers Escape the Law of One Price?

Chapter © 2014

Platform Competition: Market Structure and Pricing

Chapter © 2020

Avoid common mistakes on your manuscript.

Introduction

Setting prices relative to competitors, i.e., competitive pricing, Footnote 1 is a classical marketing problem which has been studied extensively before the emergence of e-commerce (Talluri and van Ryzin 2004; Vives 2001). Although literature on online pricing has been reviewed in the past (Ratchford 2009), interrelations between pricing and competition were rarely considered systematically (Li et al. 2017). As less than 2% of high-impact journal articles address pricing issues (Toni et al. 2017), pricing strategies do not receive proper research attention according to their practical relevance. This research gap holds even more for competitive pricing. In the past, the monopolistic assumption that demand for homogeneous goods mostly depends on prices set by a single firm may have been a viable simplification since price comparisons were difficult. Today, consumer search costs Footnote 2 shrink as the prices of most goods can be compared on relatively transparent online markets. Therefore, demand is increasingly influenced by prices of competitors which therefore should not be ignored (Lin and Sibdari 2009).

In the early 1990s, few people anticipated that business-to-consumer (B2C) online goods retail markets Footnote 3 would develop from a dubious alternative to conventional “brick-and-mortar” retail stores to an omnipresent distribution channel for all kinds of products in less than two decades (Balasubramanian 1998; Boardman and McCormick 2018). In 2000, e-commerce accounted for a mere 1% of overall retail sales. In 2025, e-retail sales are projected to account for nearly 25% of global retail sales (Lebow 2019). Traditional offline channels are nowadays typically complemented by online technologies (Gao and Su 2018). With digitization of various societal sectors in general and the COVID-19 pandemic in particular, the shift toward online channels is unlikely to stop in the future. Besides direct online shops, two-thirds of e-commerce sales are sold through online marketplaces/platforms like Alibaba, Amazon or eBay (Young 2022). The marketplace operator acts as an intermediary (two-sided platform) who matches demand (online consumers) with supply (retailers). Whereas the retailer retains control over product assortment and prices, he has to pay a commission to the marketplace operator (Hagiu 2007). However, these intermediaries often act as sellers themselves, thereby posing direct competition to retailers who have to decide between direct or marketplace channels (Ryan et al. 2012).

Online consumer markets fundamentally differ from offline settings (Chintagunta et al. 2012; Lee and Tan 2003; Scarpi et al. 2014; Smith and Brynjolfsson 2001). Factors which make competition even more prevalent for online than for offline markets are summarized in Table 1.

Development of research domains

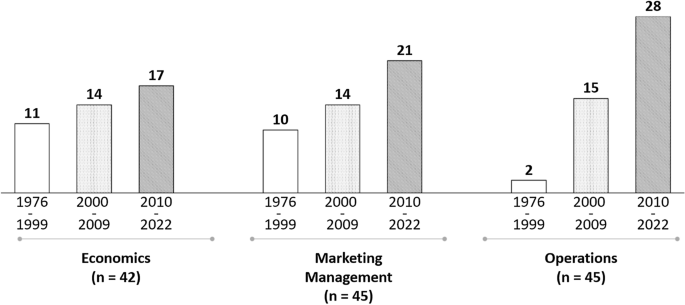

Competitive pricing literature typically can be assigned to one of the following research domains:

The economics domain takes a market perspective across individual firms. It elaborates on the existence and uniqueness of competitive equilibria also including all subjects regarding econometrics.

The marketing management domain analyzes competitive pricing problems from the perspective of a single firm with a focus on customer reactions to pricing decisions. It includes all subjects linked to marketing, strategy, business, international, technology, innovation, and general management.

The operations domain considers quantitative pricing solutions for, among others, quantity planning, choice of distribution channels, and detection of algorithm driven price collusion. It includes all subjects regarding computer science, industrial and manufacturing engineering, and mathematics.

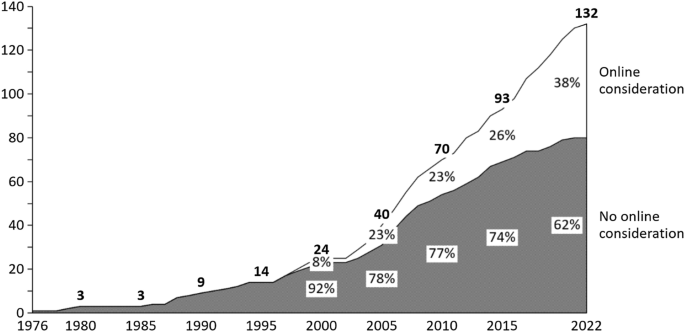

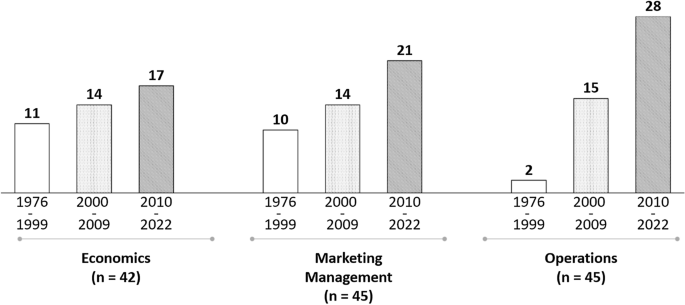

Separating the last 47 years of competitive pricing research into three intervals, all reviewed papers are assigned to their most affiliated research domain. Although the domains are similarly represented in our review (see Fig. 2), we see differences in their temporal change. Whereas rather theoretical economic subjects are covered relatively constant over time, more practice-oriented marketing management and operations subjects gained momentum since 2000. This suggests a shift from model conceptualization toward applicable research, frequently based on empirical data.

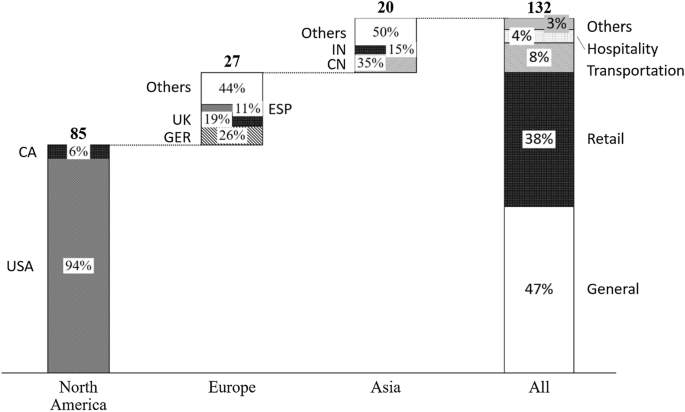

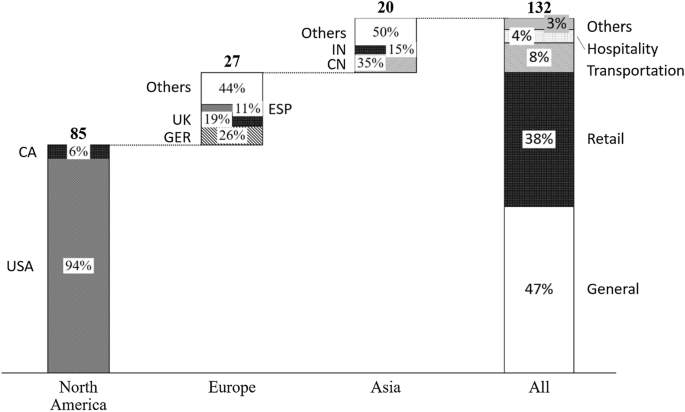

Geographical and industry context

As the origin of revenue management lies in transportation and hospitality optimization problems, one could expect that competitive pricing research also originates in these dynamic sectors. However, our analysis reveals a different picture: Almost half of the papers in our review do not concentrate on a specific industry. Besides, most industry-specific competitive pricing articles focus on retail, with 38% concentrating on the retail industry versus 8% and 4% on transportation and hospitality, respectively (see Fig. 3). This supports our proposition in chapter 1 that effects of competition on industry-specific pricing are particularly relevant for online markets.

Competitive pricing literature is predominantly driven by researchers employed by U.S. institutions (60%). The remaining 40% consist of Europe (19%), Asia (17%) and Canada (4%).

Research approach

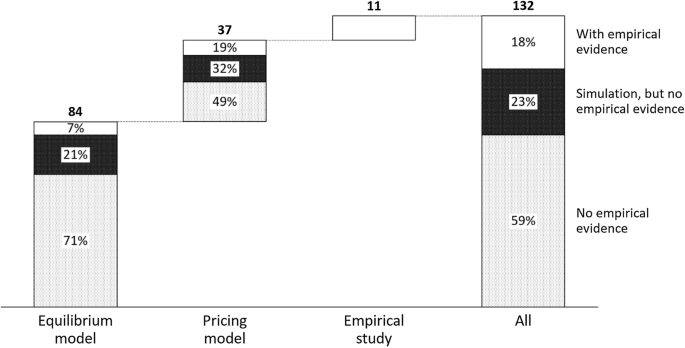

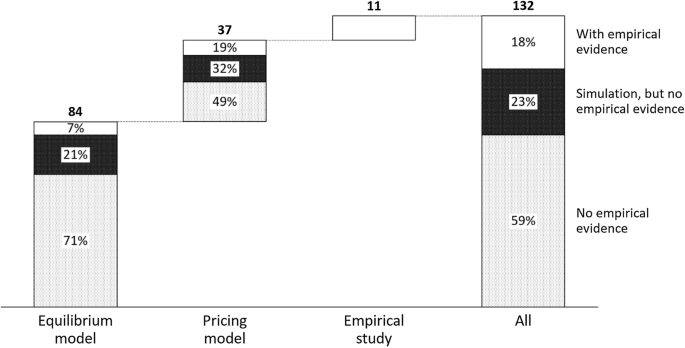

A lack of empirical testing is an issue that hampers competitive pricing research. Liozu (2015) reported that only 15% of general pricing literature include empirical data. For competitive pricing, the situation appears even more aggravated. In addition to parameters such as price elasticities and stock levels of the company under study, comprehensive, real-time information of other market participants is crucial to add practical value.

For instance, to solve a simple Bertrand equilibrium, Footnote 6 full information of all competitors is needed, which is rarely available in real-life settings. Therefore, many problems covered in the literature are of a theoretical nature. In accordance with Liozu (2015), we find that only 18% of reviewed articles use empirical evidence to validate hypotheses. An additional 23% strive to ameliorate this shortage through simulation data and numerical examples. The remaining 59% fail to bring any empirical evidence or numerical examples.

As can be taken from Fig. 4, missing empirical support is particularly prevalent for equilibrium models which use empirical data in only 7% of all papers.

Competitive pricing on online markets

In this chapter, we assess the applicability of competitive pricing work to online markets. Typical characteristics of competitive B2C pricing models were derived from literature described in chapter 2. Competitive pricing literature can be classified along four characteristics depicted in Table 3 that form the market environment in which firms compete for consumer demand.

Table 3 Key questions and classification parameters of competitive model characteristics

In the remainder of chapter 3, we discuss the four key questions in more depth and elaborate on their applicability to online retail markets.

Product similarity

In general, products in competitive pricing models are either identical (homogeneous) or differentiated by at least one quality parameter (heterogeneous). In case of homogeneous products, pricing is the only purchase decision variable—a perfectly competitive setting (Chen and Chen 2015). However, many firms strive to differentiate their products as this shifts the focus from the price as competitive lever to other product-related features (Afeche et al. 2011; Boyd and Bilegan 2003; Thomadsen 2007). According to Lancaster (1979), there are two types of product differentiation: vertical and horizontal differentiation. Vertical differentiation Footnote 7 encompasses all product distinctions which are objectively measurable and quantifiable regarding their quality level. Horizontal differentiation Footnote 8 can manifest in many variants and includes all product-related aspects which cannot be quantified according to their quality levels. Footnote 9 A key difference in the modeling of substitutable yet differentiated versus identical goods is that customers have heterogenous preferences among products. Footnote 10 A recent stream of literature approaches unknown differentiation criteria by assessing online consumer-generated content (DeSarbo and Grewal 2007; Lee and Bradlow 2011; Netzer et al. 2012; Ringel and Skiera 2016; Won et al. 2022).

Besides the chosen price level, Cachon and Harker (2002) argue that firms compete with the operational performance level offered and perceived, i.e., service level in online retail, to differentiate an otherwise homogenous offering. In situations, where resellers with comparable service and shipping policies offer similar products, price is a major decision variable for potential buyers (Yang et al. 2020). Often, e-tailers do not possess the right to exclusively distribute a certain product. For example, Samsung’s Galaxy S21 5G was offered by 69 resellers on the German price comparison website Idealo.de. Footnote 11 As some products in e-tail can be differentiated and others cannot, both identical and differentiated product research have their raison d’être for competitive online pricing.

Most competitive pricing models only address the effects of single-product settings. This simplification is reasonable if there is no interdependence between products of an e-tailer (Gönsch et al. 2009). Taking up on the smartphone example, the prices of close substitutes, such as Huawei’s P30 Pro, nonetheless have an impact on the demand of Samsung’s Galaxy S21 5G. To further extent product differentiation, price models have to incorporate multi-product pricing problems in non-cooperative settings (Chen and Chen 2015). Such models have to account not only for demand impact of directly competing products but also for synergies, cannibalization/substitution effects of (own) differentiated goods. Although there is a recent research stream regarding product assortment (Besbes and Sauré 2016; Federgruen and Hu 2015; Heese and Martínez-de-Albéniz 2018; Nip et al. 2020; Sun and Gilbert 2019), multi-product work is still underdeveloped. Thus, competitive multi-product pricing constitutes an area which should be addressed in future research.

Product durability

The durability of products is an important feature to differentiate between competitive pricing model types. Durable (non-perishable) products do not have an expiration date, for example consumer durables such as household appliances. Perishable products can only be sold for a limited time interval and have a finite sales horizon. After expiration date, unused capacity is lost or significantly devalued to a salvage value. Footnote 12 Combined with limited capacities, the firm objective is thus most often to maximize turnover under capacity constraints and finite sales horizon (Gallego and van Ryzin 1997; McGill and van Ryzin 1999; Weatherford and Bodily 1992).

Perishability can be of relevance for products with seasonality effects or short product life cycles (i.e., finite selling horizon) such as apparel, food groceries or winter sports equipment. This is especially relevant because online retailers of perishable products are severely restricted in their shipment, return handle policies and supply chain length (Cattani et al. 2007). Sellers cannot replenish their inventory after the planning phase and cannot retain goods for future sales periods (Perakis and Sood 2006). Some products like apparel—albeit reducing in value after a selling season—still have a certain salvage value and can be sold at reduced prices (Anand and Girotra 2007).

It depends on the type of product to decide whether perishability should be included in competitive pricing models. There is a fundamental distinction in the underlying optimization objective for models with or without perishability. Whereas models with perishable products tend to focus on revenue maximization over a definite short-term time horizon, models with durable products tend to focus on profit maximization over an indefinite or at least long-term time horizon by balancing current revenues of existing and future revenues of new customers. To account for this trade-off, models with durable products need to discount future cash flows incorporating time value of money, stock-keeping, opportunity and other costs related to prolonged sales (Farias et al. 2012). To conclude, perishability cannot be treated as an extension to durable models but rather as a separate class of pricing models. Depending on the product and/or setting in focus, both are relevant for online retailing. Further research could investigate the performance of models with and without consideration of perishability in various (online) settings to determine when it is appropriate to use which class of pricing models. Also, an interesting field of future studies arises around the question which instruments (e.g., service differentiations or price diffusion) are used by online retailers to differentiate otherwise homogeneous offerings.

Time dependence

A key differentiator of competitive pricing models is the consideration of either a static (time-independent) setup with definite equilibrium or a dynamic (time-dependent) constellation with changing environmental factors and equilibria. Albeit static pricing models have no time component, many consist of multiple stages to investigate the interplay of different factors. Footnote 13 In contrast, dynamic models allow for varying competitive (re-)actions over time. Footnote 14 Within the latter category, there are models with a finite (Afeche et al. 2011; Levin et al. 2008; Liu and Zhang 2013; Yang and Xia 2013) and an infinite (Anderson and Kumar 2007; Li et al. 2017; Schlosser and Richly 2019; Villas-Boas and Winer 1999; Weintraub et al. 2008) time horizon.

Historically, competitive pricing models assumed fixed prices over the considered time horizon. Limited computational power made it impossible to appropriately estimate models dynamically due to dimensionality issues (Schlosser and Boissier 2018). A lack of reliable demand information, high menu and investment costs to implement dynamic approaches were additional reasons why pricing models remained inherently static without incorporating changing competitive responses (Ferreira et al. 2016). The focus in retail has conventionally rather been on long-term profit optimization and to a lesser degree on dynamically changing price optimizations (Elmaghraby and Keskinocak 2003).

The literature disagrees on whether firms should opt for static or dynamic pricing strategies. A static environment allows to simplify and concentrate on a specific topic such as equilibrium discussions. For instance, Lal and Rao (1997) study success factors of everyday low pricing and derive conditions for a perfect Nash equilibrium between an everyday low price retailer and a retailer with promotional pricing. With Zara as an example for a company with a successful static pricing strategy, Liu and Zhang (2013) argue that with the presence of strategic customers who prolong sales in anticipation of price decreases, firms might even be better off to deploy static over dynamic price setting processes. Studying the time-variant pricing plans in electricity markets, Schlereth et al. (2018) suggest that consumers might prefer static over dynamic pricing because of factors like choice confusion, lack of trust in price fairness, perceived economical risk or perceived additional effort. Further support for a static pricing strategy is found in Cachon and Feldman (2010) and Hall et al. (2009).

Nevertheless, to generalize that static should strictly be preferred over dynamic pricing models could be short-sighted. Firms cannot generally infer future behavior of competitors from past observations to assess how competitive (re-) actions may influence the optimal pricing policy (Boer 2015b). Corresponding to the surge of revenue management systems in the airline industry during the 70s and 80s, increased price and demand transparency, low menu costs and an abundance of decision support software created fierce competition among online retailers (Fisher et al. 2018). Taking up on the above mentioned example by Liu and Zhang (2013), Caro and Gallien (2012) show that even Zara does not solely rely on static pricing. They supported Zara’s pricing team in designing and implementing a dynamic clearance pricing optimization system—to generate a competitive advantage in addition to the fast-fashion retail model Zara mainly pursues (Caro 2012). Zhang et al. (2017) discuss various duopoly pricing models with static and dynamic pricing under advertising. They find that market surplus is highest when one firm prices dynamically, profiting from the static behavior of the other. Chung et al. (2012) provide numerical evidence that a dynamic pricing model with an appropriately specified demand estimation always outperforms static pricing strategies—also in settings with incomplete information. Xu and Hopp (2006) show that dynamic pricing outperforms preannounced pricing, especially with effective inventory management and elastic demand. Further support for advantages of dynamic pricing can be found by Popescu (2015), Wang and Sun (2019), and Zhang et al. (2018b). Empirical evidence of the negative consequences of sticking to a static strategy in a changing environment is found in the cases of Nokia, Kodak, and Xerox.

While some scholars distinguish between discrete and continuous dynamic pricing systems (Vinod 2020), we suggest to classify dynamic pricing models according to their level of sophistication into two evolutionary stages: the (in e-commerce widely applied) manual rule-based pricing approach and the data-driven algorithmic optimization approach (Popescu 2015; Le Chen et al. 2016). Footnote 15 For the rule-based approach, “if-then-else rules” are defined and updated manually. Footnote 16 However, the mere number of stock-keeping units (SKUs) in today’s retailer offerings aggravate the initial setup and handling of rule-based pricing and make real-time adjustments unmanageable (Schlosser and Boissier 2018). In addition, rule-based approaches are rather subjective than sufficiently data-driven. Faced with a large range of SKUs, competitor responses and heterogeneous demand elasticities, canceling out the human decision-making process on an operational level is the next evolutionary step for competitive pricing systems (Calvano et al. 2020). Data-driven algorithmic pricing strategies use observable market Footnote 17 data to predict sales probabilities based on consumer demand and competitive responses (Schlosser and Richly 2019).

As online marketplaces benefit from an increased number of retailers on their platforms, they typically support sellers to establish automated dynamic pricing systems (Kachani et al. 2010). Footnote 18 However, Schlosser and Richly (2019) claim that current dynamic pricing systems are not able to deal with the complexity of competitor-based pricing and therefore most often ignore competition altogether or solely rely on manually adjusted rule-based mechanics. Challenges include the indefinite spectrum of changing competitor strategies, asymmetric access to competitor knowledge, a large solution space under limited information and the black-box character of dynamic systems, which exacerbates an intervention in case of a pricing system malfunction. Besides, researchers did not yet identify an algorithm which consistently outperforms other methodologies in competitive situations. Instead, it depends on the specific setting and other competitors’ pricing behavior to assess which pricing algorithm is optimal (van de Geer et al. 2019) exacerbating the application of such systems.

Reflecting the literature findings for both static and dynamic pricing strategies, we conclude that pricing managers should develop dynamic pricing models in most e-commerce situations. As long as demand and competitor price responses vary over time on online markets, dynamic models are naturally superior to time-independent approaches. Static models on the other hand are only appropriate in market constellations with little time-varying demand and competitor behavior. As static research can be expected to remain a vivid field of literature, further research with regard to the transferability of static models to dynamic settings is desirable. In addition, more research is needed that helps to better understand the implications of widely applied rule-based dynamic pricing methods and their transition toward algorithmic approaches (Boer 2015a; van de Geer et al. 2019; Kastius and Schlosser 2022; Könönen 2006).

Market structure

The market structure describes the number of competing firms such as duopoly or oligopoly in a demand setting with an indefinite number of consumers. 60% of the reviewed papers studied duopolies, 49% oligopolies, 7% monopolistic competition, and 3% perfect competition. Footnote 19

Especially for research in the economics stream, many papers assume a perfectly competitive market. Pricing research with perfectly competitive markets (e.g., van Mieghem and Dada 1999 or Yang and Xia 2013) is likely to be of very limited value to online retailers. Building on the notion of Diamond (1971), Salop (1976) argues that if customers have positive information gathering costs, no perfect competition can occur as firms have room to slightly increase prices without losing demand. Christen (2005) found evidence that even with strong competition and low information costs, cost uncertainty could decrease the detrimental effect of competition for sellers and could increase prices above Bertrand levels. Similarly, Bryant (1980) showed that perfect competition is not possible in a market with uncertain demand, even if the number of firms is large and customers have no search costs. Rather, price dispersion reflects uncertain demand (Borenstein and Rose Nancy L. 1994; Cavallo 2018; Clemons et al. 2002; Obermeyer et al. 2013; Wang et al. 2021). Israeli et al. (2022) empirically show that the market power of individual firms does not only depend on the number and intensity of competitors but also on the firm’s ability to adjust prices in response to varying inventory levels of product substitutes, especially with low consumer search costs. This is of relevance for e-commerce as e-tailers could exploit this dependence by incorporating competitors’ stock levels into pricing decisions (Fisher et al. 2018).

Some papers discuss (quasi) monopolistic competition (e.g., Xu and Hopp 2006) in which small firms charge the (higher) monopoly price rather than the (lower) competitive price. From an empirical study in the U.S. airline industry, Chen (2018) concludes that, as firms can price discriminate late-arriving consumers, competition is softened, profits are increased, and the only single-price equilibrium could be at the monopoly price. This supports Lal and Sarvary (1999) who show that online retailers enjoy a certain amount of monopoly power in cases where buyers cannot switch suppliers for repeated purchases (e.g., technical incompatibility reasons). In such cases, switching costs could increase online prices (Chen and Riordan 2008). However, this contradicts Deck and Gu (2012) who empirically show that, although the distribution of buyer values of competing products might theoretically lead to higher prices through competition, intensity of competition rarely allows for an occurrence of this phenomenon in e-tail settings.

Although duopoly settings can serve to assess the relevant strength of pricing strategies, which is not directly possible for oligopoly markets due to the curse of dimensionality (Kastius and Schlosser 2022), they cannot be transferred to more competitive environments (van de Geer et al. 2019). In online retail, a duopoly market structure is a rare exemption. Like for perfectly competitive markets, findings of duopoly research must be carefully assessed in terms of their applicability to online retail oligopolies.

Bresnahan and Reiss (1991) found empirical evidence that markets with an increasing number of dealers have lower prices than in less competitive market structures such as monopolies or duopolies. Although applicable to many online retail markets, where retailers face dozens, if not hundreds of thousands of competitors (Schlosser and Boissier 2018), few research attention is currently given toward a structure with a large number of competitors in an imperfect market (cf. Li et al. 2017). A way to assess the current competitive structure of markets is the utilization of online consumer-generated content such as forum entries (Netzer et al. 2012; Won et al. 2022) or clickstream data (Ringel and Skiera 2016) and actual sales data (Kim et al. 2011).

In many countries with well-developed B2C online markets, one or few major retailers dominate on an oligopolistic market. For example, the top three online retailers in the United States accounted for over 50% of the revenue generated on the national e-commerce market in 2021. Footnote 20 Due to lower locational limitations in conjunction with substantial economies of scale and scope, online markets tend to become more concentrated than their offline counterparts (Borsenberger 2015). Although one could expect that increased market transparency leads to a higher intensity of competition (Cao and Gruca 2003), limiting the market power of established firms and leaving growth potential for smaller firms (Zhao et al. 2017), it appears reasonable to predict that most online markets will ultimately resemble an oligopoly setting with a with a relatively small number of players—enabling increased tacit pricing algorithm collusion in the future (Calvano et al. 2020). With few exceptions (e.g., Noel 2007), there is little research (Brown and Goolsbee 2002; Wang et al. 2021; Cavallo 2018) exploring what type of competitor-based pricing strategies are used and what competitive dynamics are found on e-tail markets. Thus, more research is needed to investigate the current state of market structure and intensity of competition in today’s e-commerce markets as drivers of the selection and the outcomes of pricing approaches.

Implications and directions

We contribute to the literature by providing an interdisciplinary review of competitive online retail research. Competitive pricing problems can most often be assigned to one of the academic fields of economics, marketing management or operations. In a first step, this review offered a descriptive portrayal of the relevant literature. Motivated by practical issues and common features in competitive pricing research, we then structured competitive pricing contributions along four properties of pricing models. First, do firms compete with identical or quality differentiated products? Second, are products to be considered as perishable or durable goods? Third, is the market setting to be regarded time-independent or not? Fourth, which market structure prevails on e-tail markets? The framework is derived from an analysis of pricing research not exclusively restricted to online retail settings. Therefore, it could be extended to other online or offline markets, with little loss of generalizability.

We focused on e-tail markets because the relevance of competition for pricing strategies is disproportionally higher in such environments. On e-tail online markets, products are rarely offered exclusively so that the likelihood of substitutive competition is high. Nevertheless, products can be differentiated through other factors than prices such as generous shipping, customer retention (e.g., loyalty reward programs) or return and issue handling policies. With a look on product similarities, accounting for product interdependencies and multi-product situations are important improvements of prevailing pricing models. Second, pricing models with both a focus on perishable and/or durable products are relevant on e-tail markets. However, further research is needed exploring which of the respective perishability considerations are appropriate for different settings. Third, we conclude that, albeit time-independent static models may occasionally serve to simplify pricing issues, dynamic models outperform their static counterparts in constantly changing market environments such as in e-commerce. Fourth, we show that in most practical settings, online markets resemble either an oligopolistic market structure or a structure with many firms under imperfect competition. Thus, future research should consider these two “real” competitive settings instead of further looking at simplifying market structures such as monopolistic or duopolistic competition. This should ease a transfer of theoretical insights into practical applications. To sum, firms should be able to improve their competitive position by developing a profit optimizing dynamic pricing strategy for identical products in an oligopolistic setting with a varying number and relevance of competitors.

Due to space limitations, we had to focus on competitive pricing model characteristics related to four overall product and market attributes. Thus, more work is needed on other characteristics of competitive pricing models, particularly firm- and consumer-related characteristics. Firm-related characteristics encompass various additional properties of interacting firms (e.g., similarity or capacity constraints). Similarly, consumer-related characteristics entail further properties of interacting buyers (e.g., certainty, discreteness, sophistication, and homogeneity of demand).

In the selection process of literature, this study only considered papers in peer-reviewed journals and conference proceedings in English. Subsequent research could complement our findings by including industry-funded, unpublished and non-peer-reviewed articles, also in other languages. In addition, we do not claim that our research captures all competitive pricing publications of the considered field. As our study spans almost 50 years of a frequently discussed topic in the domains of economics, marketing management, and operations, we had to constrain the scope to the most influential work. Although we mutually evaluated our selection decisions and consulted outside peers for validation and further input, we cannot eliminate the element of subjectivity. Consequently, other authors could have selected slightly different papers. However, this shortcoming is unlikely to significantly affect our results as our literature selection was derived from a broad array of competitive pricing research and would therefore be only marginally influenced by a few omitted articles.

Notes

Competitive pricing includes all activities and processes to price products with the consideration of competitors. This does not only include rigidly pegging prices to competitor prices but rather a comprehensive consideration of current and expected price (re-)actions of competing firms to sustainably ensure profit maximization. In this article, the terms competitive pricing, competitor-oriented pricing and competitor-based pricing are used synonymously.

Search costs are defined as the costs of time and resources to acquire information with respect to price, assortment, and quality characteristics of the goods provided by different sellers. The internet dramatically reduces search costs through price comparison websites such as Google Shopping, Shopzilla (USA) or Idealo (Germany).

Business-to-consumer (B2C) online retail sales encompass all forms of electronic commerce markets in which residential end customers can directly buy goods from a seller over the internet through a web browser or a mobile app. In this paper, the terms business-to-consumer (B2C) online goods retail, online retail, e-tail, e-retail and e-commerce markets are used synonymously.

In contrast to classical quantity-based revenue management, dynamic pricing, also known as surge pricing, is the practice of adjusting prices according to current market demand (Boer 2015a). Revenue management, also known as yield management, is a type of price discrimination which originates from the airline and hospitality industries. Typically, revenue management models assume fixed capacities, low marginal cost, varying demand and highly perishable inventory (Talluri and van Ryzin 2004).

Keywords used for abstract, title and keyword screening were “competitive pricing”, “competitor-based pricing”, “competition” AND “pricing”. To find literature for online pricing in particular, the search was combined with the keywords “online”, “e-retail”, “ecommerce” and “e-commerce”. Whereas the combination was scanned in great depths, the three competitive keywords were screened for influential papers with implications for online markets.

Bertrand competition is a simplified model of competition to explain price competition among (at least) two firms for an identical product at equal unit cost of production. Prices are set simultaneously, and consumers buy without search costs from the firm with the lowest price. When all firms charge the same price, consumer demand is split evenly between firms. A firm is willing to supply unlimited amounts of quantities above the unit cost of production and is indifferent to supply at unit cost as it will earn zero profit. The only Bertrand equilibrium exists when prices are equal to unit cost (i.e., competitive price) as each firm otherwise would have an incentive to undercut all other competitors and thereby rake in the entire market demand. Therefore, there can be no equilibrium at prices above the competitive price and price dispersion cannot occur.

In vertical differentiation, consumer choice depends on specific quality levels of product attributes. At the same price, all consumers prefer one product over other products, for example because of superior design. In the simplest form, products differ in one attribute and customers are willing to pay marginal increments of this attribute.

In horizontal differentiation, consumer choice depends on preferences for products. At the same price, some customers would buy one product and others other products.

We consider product differentiation only to product-related differentiation attributes. However, in competitive pricing literature firm-related differences such as firm loyalty or distribution channels are occasionally attributed to differentiation. For example, Abhishek et al. (2016) differentiate online distribution channels of otherwise homogeneous products and firms.

Heterogeneous customer preferences are a key requirement for product differentiation, otherwise price constitutes the only driver of the buying decision (Li et al. 2017). Without heterogeneity in consumers’ marginal willingness to pay for different levels of product quality, there can be no product differentiation (Pigou 1920).

Accessed 14–03-2022.

Salvage value is defined as the residual cash-flow of a good after its expiration date.

For example, game settings on the foundation of Stackelberg games necessarily comprise ≥ 2 stages (Geng and Mallik 2007; Gupta et al.; Wang et al. 2020; Yao and Liu 2005). Another example would be Anand and Girotra (2007) who propose a 3-stage model in which they include the supply chain configuration and determination of production quantities in addition to the actual price setting.

As such, we classify n-stage models as dynamic models when not all individual stages serve a specific time-independent purpose.

For instance, the Brandenburg consumer advice center (Verbraucherzentrale Brandenburg) examined dynamic price differentiation in online retail and found that 15 of the 16 observed German online shops dynamically changed their prices in 2018 (Dautzenberg et al. 2018).

A typical rule would be to set prices always x% lower than competitor prices up to a certain profit threshold.

Observable market data include price and stock levels of competitors (Fisher et al. 2018) or clickstream and keyword data of customers (Li et al. 2017).

Examples for support programs by online marketplaces are Amazon’s Seller Central (https://sellercentral.amazon.com/gp/help/external/G201994820?language=en_US&ref=efph_G201994820_cont_43381; Accessed 14–03-2022), eBay’s Seller Tools (https://pages.ebay.com/sell/automation.html; Accessed 14–03-2022) or Idealo’s Partner Program (https://partner.idealo.com/de; Accessed 14–03-2022).

Cumulatively, these values exceed 100% as some articles discussed more than one kind of market structure. Applied by economists to simplify real markets as the foundation of price theory, perfect competition relates to a market structure which is controlled entirely by market forces and not by individual firms. Instead, individual firms only act as price takers and cannot earn any economic profit. The conditions for a perfect competition, such as full information, homogeneous products, fully rational buyers, no scale, network or externality effects, no entry barriers, and no transaction costs, are rarely attainable in practical settings (Stigler 1957). If not all conditions for perfect competition are fulfilled, the market structure is imperfect which applies to most practical settings. Besides a monopoly with only one seller on the market, three market structures with competing firms exist: Monopolistic, duopolistic, and oligopolistic competition. An oligopoly is characterized by a small number of firms in which the behavior of one firm drives the actions of other firms. A duopoly is a particular case of an oligopoly in which two firms control the market. An extreme case of imperfect competition is (quasi) monopolistic competition in which products are differentiated and firms maintain a certain spare capacity giving them a certain degree of pricing power to maximize their (short-term) profits. In consequence, prices can be higher than corresponding the competitive (Bertrand) price (Vives 2001).

For an overview of the top 15 online shops in the United States in 2021, see Davidkhanian (2021).

References

- Abhishek, Vibhanshu, Kinshuk Jerath, and Z. John Zhang. 2016. Agency selling or reselling? Channel structures in electronic retailing. Management Science 62 (8): 2259–2280. https://doi.org/10.1287/mnsc.2015.2230. ArticleGoogle Scholar

- Adida, Elodie, and Georgia Perakis. 2010. Dynamic pricing and inventory control: Uncertainty and competition. Operations Research 58 (2): 289–302. https://doi.org/10.1287/opre.1090.0718?journalCode=opre. ArticleGoogle Scholar

- Afeche, Philipp, Hu Ming, and Yang Li. 2011. Reorder flexibility and price competition for differentiated seasonal products with market size uncertainty. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.1976886. ArticleGoogle Scholar

- Aggarwal, Praveen, and Taihoon Cha. 1998. Asymmetric price competition and store vs. national brand choice. Journal of Product & Brand Management 7 (3): 244–253. https://doi.org/10.1108/10610429810222877. ArticleGoogle Scholar

- Aksoy-Pierson, Margaret, Gad Allon, and Awi Federgruen. 2013. Price competition under mixed multinomial logit demand functions. Management Science 59 (8): 1817–1835. https://doi.org/10.1287/mnsc.1120.1664. ArticleGoogle Scholar

- Allen, Beth, and Martin Hellwig. 1986. Bertrand-Edgeworth oligopoly in large markets. Review of Economic Studies 53 (2): 175–204. https://doi.org/10.2307/2297646. ArticleGoogle Scholar

- Anand, Krishnan S., and Karan Girotra. 2007. The strategic perils of delayed differentiation. Management Science 53 (5): 697–712. https://doi.org/10.1287/mnsc.1060.0655. ArticleGoogle Scholar

- Anderson, Eric T., and Nanda Kumar. 2007. Price competition with repeat, loyal buyers. Quantitative Marketing and Economics 5 (4): 333–359. https://doi.org/10.1007/s11129-007-9023-7. ArticleGoogle Scholar

- Anderson, Chris K., Henning Rasmussen, and Leo MacDonald. 2005. Competitive pricing with dynamic asymmetric price effects. International Transactions in Operational Research 12 (5): 509–525. https://doi.org/10.1111/j.1475-3995.2005.00522.x. ArticleGoogle Scholar

- Anton, James J., Gary Biglaiser, and Nikolaos Vettas. 2014. Dynamic price competition with capacity constraints and a strategic buyer. International Economic Review 55 (3): 943–958. https://doi.org/10.1111/iere.12077. ArticleGoogle Scholar

- Anufriev, Mikhail, Dávid Kopányi, and Jan Tuinstra. 2013. Learning cycles in bertrand competition with differentiated commodities and competing learning rules. Journal of Economic Dynamics and Control 37 (12): 2562–2581. https://doi.org/10.1016/j.jedc.2013.06.010. ArticleGoogle Scholar

- Armstrong, J. Scott, and Kesten C. Green. 2007. Competitor-oriented objectives: Myth of market share. International Journal of Business 12 (1): 117–136. Google Scholar

- Ba, Sulin, Jan Stallaert, and Zhongju Zhang. 2012. Research note—Online price dispersion: A game-theoretic perspective and empirical evidence. Information Systems Research 23 (2): 575–592. https://doi.org/10.1287/isre.1110.0353. ArticleGoogle Scholar

- Babaioff, Moshe, Renato Paes Leme, and Balasubramanian Sivan. 2015. Price competition, fluctuations, and welfare guarantees. In EC '15: Proceedings of the Sixteenth ACM Conference on Economics and Computation, Portland, USA. 15-Jun-15 - 19-Jun-15. https://doi.org/10.48550/arXiv.1411.2036

- Balakrishnan, Anantaram, Shankar Sundaresan, and Bo. Zhang. 2014. Browse-and-switch: Retail-online competition under value uncertainty. Production and Operations Management 23 (7): 1129–1145. https://doi.org/10.1111/poms.12165. ArticleGoogle Scholar

- Balasubramanian, Sridhar. 1998. Mail versus mall: A strategic analysis of competition between direct marketers and conventional retailers. Marketing Science 17 (3): 181–195. https://doi.org/10.1287/mksc.17.3.181. ArticleGoogle Scholar

- Baloglu, Seyhmus, and Lisa Marie Assante. 1999. A content analysis of subject areas and research methods used in five hospitality management journals. Journal of Hospitality & Tourism Research 23 (1): 53–70. https://doi.org/10.1177/109634809902300105. ArticleGoogle Scholar

- Bernstein, Fernando, and Awi Federgruen. 2004. A general equilibrium model for industries with price and service competition. Operations Research 52 (6): 868–886. https://doi.org/10.1287/opre.1040.0149. ArticleGoogle Scholar

- Bernstein, Fernando, and Awi Federgruen. 2005. Decentralized supply chains with competing retailers under demand uncertainty. Management Science 51 (1): 18–29. https://doi.org/10.1287/mnsc.1040.0218. ArticleGoogle Scholar

- Bernstein, Fernando, Jing-Sheng Song, and Xiaona Zheng. 2008. “Bricks-and-mortar” vs. “clicks-and-mortar”: An equilibrium analysis. European Journal of Operational Research 187 (3): 671–690. https://doi.org/10.1016/j.ejor.2006.04.047. ArticleGoogle Scholar

- Bertrand, Joseph Louis François. 1883. Thèorie mathèmatique de la richesse sociale. Journal des Savants 499–508.

- Bertsimas, Dimitris, and Georgia Perakis. 2006. Dynamic pricing: A learning approach. In Mathematical and computational models for congestion charging, ed. Siriphong Lawphongpanich, Donald W. Hearn, and Michael J. Smith, 45–79. Boston: Kluwer Academic Publishers. ChapterGoogle Scholar

- Besbes, Omar, and Denis Sauré. 2016. Product assortment and price competition under multinomial logit demand. Production and Operations Management 25 (1): 114–127. https://doi.org/10.1111/poms.12402. ArticleGoogle Scholar

- Bischi, Gian-Italo, Carl Chiarella, and Michael Kopel. 2004. The long run outcomes and global dynamics of a duopoly game with misspecified demand functions. International Game Theory Review 6 (3): 343–379. https://doi.org/10.1142/S0219198904000253. ArticleGoogle Scholar

- Blattberg, Robert C., and Kenneth J. Wisniewski. 1989. Price-induced patterns of competition. Marketing Science 8 (4): 291–309. https://doi.org/10.1287/mksc.8.4.291. ArticleGoogle Scholar

- Boardman, Rosy, and Helen McCormick. 2018. Shopping channel preference and usage motivations. Journal of Fashion Marketing and Management: An International Journal 22 (2): 270–284. https://doi.org/10.1108/JFMM-04-2017-0036. ArticleGoogle Scholar

- Boccard, Nicolas, and Xavier Wauthy. 2000. Bertrand competition and Cournot outcomes: Further results. Economics Letters 68 (3): 279–285. https://doi.org/10.1016/S0165-1765(00)00256-1. ArticleGoogle Scholar

- Borenstein, Severin, and L. Rose Nancy. 1994. Competition and price dispersion in the U.S. airline industry. Journal of Political Economy 102 (4): 653–683. https://doi.org/10.1086/261950. ArticleGoogle Scholar

- Borsenberger, Claire. 2015. The concentration phenomenon in e-commerce. In Postal and delivery innovation in the digital economy, ed. Michael A. Crew and Timothy J. Brennan, 31–41. Cham: Springer International Publishing. ChapterGoogle Scholar

- Boyd, E. Andrew, and Ioana C. Bilegan. 2003. Revenue management and e-commerce. Management Science 49 (10): 1363–1386. https://doi.org/10.1287/mnsc.49.10.1363.17316. ArticleGoogle Scholar

- Bresnahan, Timothy F., and Peter C. Reiss. 1991. Entry and competition in concentrated markets. Journal of Political Economy 99 (5): 977–1009. https://doi.org/10.1086/261786. ArticleGoogle Scholar

- Brown, Jeffrey R., and Austan Goolsbee. 2002. Does the internet make markets more competitive? Evidence from the life insurance industry. Journal of Political Economy 110 (3): 481–507. https://doi.org/10.1086/339714. ArticleGoogle Scholar

- Bryant, John. 1980. Competitive equilibrium with price setting firms and stochastic demand. International Economic Review 21 (3): 619–626. https://doi.org/10.2307/2526357. ArticleGoogle Scholar

- Brynjolfsson, Erik, and Michael D. Smith. 2000. Frictionless commerce? A comparison of internet and conventional retailers. Management Science 46 (4): 563–585. https://doi.org/10.1287/mnsc.46.4.563.12061. ArticleGoogle Scholar

- Cachon, Gérard P., and Pnina Feldman. 2010. Dynamic versus static pricing in the presence of strategic consumers. The Wharton School, University of Pennsylvania (Working Paper).

- Cachon, Gérard. P., and Patrick T. Harker. 2002. Competition and outsourcing with scale economies. Management Science 48 (10): 1314–1333. https://doi.org/10.1287/mnsc.48.10.1314.271. ArticleGoogle Scholar

- Caillaud, Bernard, and Romain de Nijs. 2014. Strategic loyalty reward in dynamic price discrimination. Marketing Science 33 (5): 725–742. https://doi.org/10.1287/mksc.2013.0840. ArticleGoogle Scholar

- Calvano, Emilio, Giacomo Calzolari, Vincenzo Denicolò, and Sergio Pastorello. 2020. Artificial intelligence, algorithmic pricing, and collusion. American Economic Review 110 (10): 3267–3297. https://doi.org/10.1257/aer.20190623. ArticleGoogle Scholar

- Campbell, Colin, Gautam Ray, and Waleed A. Muhanna. 2005. Search and collusion in electronic markets. Management Science 51 (3): 497–507. https://doi.org/10.1287/mnsc.1040.0327. ArticleGoogle Scholar

- Cao, Yong, and Thomas S. Gruca. 2003. The effect of stock market dynamics on internet price competition. Journal of Service Research 6 (1): 24–36. https://doi.org/10.1177/1094670503254272. ArticleGoogle Scholar

- Caplin, Andrew, and Barry Nalebuff. 1991. Aggregation and imperfect competition: On the existence of equilibrium. Econometrica 59 (1): 25–59. https://doi.org/10.2307/2938239. ArticleGoogle Scholar

- Caro, Felipe. 2012. Zara: Staying fast and fresh. The European Case Clearing House. ECCH Case study 612-006-1.

- Caro, Felipe, and Jérémie. Gallien. 2012. Clearance pricing optimization for a fast-fashion retailer. Operations Research 60 (6): 1404–1422. https://doi.org/10.2139/ssrn.1731402. ArticleGoogle Scholar

- Cattani, Kyle, Olga Perdikaki, and Ann Marucheck. 2007. The perishability of online grocers. Decision Sciences 38 (2): 329–355. https://doi.org/10.1111/j.1540-5915.2007.00161.x. ArticleGoogle Scholar

- Cavallo, Alberto. 2018. More Amazon effects: online competition and pricing behaviors. National Bureau of Economic Research (Working Papers 25138).

- Cebollada, Javier, Yanlai Chu, and Zhiying Jiang. 2019. Online category pricing at a multichannel grocery retailer. Journal of Interactive Marketing 46 (1): 52–69. https://doi.org/10.1016/j.intmar.2018.12.004. ArticleGoogle Scholar

- Chen, Yongmin. 1997. Paying customers to switch. Journal of Economics Management Strategy 6 (4): 877–897. https://doi.org/10.1111/j.1430-9134.1997.00877.x. ArticleGoogle Scholar

- Chen, Ming, and Zhi-Long. Chen. 2015. Recent developments in dynamic pricing research: Multiple products, competition, and limited demand information. Production and Operations Management 24 (5): 704–731. https://doi.org/10.1111/poms.12295. ArticleGoogle Scholar

- Chen, Yongmin, and Michael H. Riordan. 2008. Price-increasing competition. RAND Journal of Economics 39 (4): 1042–1058. https://doi.org/10.1111/j.1756-2171.2008.00049.x. ArticleGoogle Scholar

- Chen, Ying-Ju, Yves Zenou, and Junjie Zhou. 2018. Competitive pricing strategies in social networks. RAND Journal of Economics 49 (3): 672–705. https://doi.org/10.1111/1756-2171.12249. ArticleGoogle Scholar

- Cheng, Kuangnen. 2017. Competitive dynamics across strategic groups: A literature review and validation by quantitative evidence of operation data. International Journal of Business Environment 9 (4): 301–323. https://doi.org/10.1504/IJBE.2017.092223. ArticleGoogle Scholar

- Chiang, Wen Chyuan, Jason C.H. Chen, and Xu Xiaojing. 2007. An overview of research on revenue management: Current issues and future research. International Journal of Revenue Management 1 (1): 97–128. https://doi.org/10.1504/IJRM.2007.011196. ArticleGoogle Scholar

- Chintagunta, Pradeep K., Junhong Chu, and Javier Cebollada. 2012. Quantifying transaction costs in online/offline grocery channel choice. Marketing Science 31 (1): 96–114. https://doi.org/10.1287/mksc.1110.0678. ArticleGoogle Scholar

- Chioveanu, Ioana. 2012. Price and quality competition. Journal of Economics 107 (1): 23–44. https://doi.org/10.1007/s00712-011-0259-z. ArticleGoogle Scholar

- Chioveanu, Ioana, and Jidong Zhou. 2013. Price competition with consumer confusion. Management Science 59 (11): 2450–2469. https://doi.org/10.1287/mnsc.2013.1716. ArticleGoogle Scholar

- Choi, S. Chan. 1996. Price competition in a duopoly common retailer channel. Journal of Retailing 72 (2): 117–134. https://doi.org/10.1016/S0022-4359(96)90010-X. ArticleGoogle Scholar

- Christen, Markus. 2005. Research note: Cost uncertainty is bliss: The effect of competition on the acquisition of cost information for pricing new products. Management Science 51 (4): 668–676. https://doi.org/10.1287/mnsc.1040.0320. ArticleGoogle Scholar

- Chu, Junhong, Pradeep Chintagunta, and Javier Cebollada. 2008. Research note: A comparison of within-household price sensitivity across online and offline channels. Marketing Science 27 (2): 283–299. https://doi.org/10.1287/mksc.1070.0288. ArticleGoogle Scholar

- Chung, Byung Sun, Jiahan Li, Tao Yao, Changhyun Kwon, and Terry L. Friesz. 2012. Demand learning and dynamic pricing under competition in a state-space framework. IEEE Transactions on Engineering Management 59 (2): 240–249. ArticleGoogle Scholar

- Clemons, Eric K., Il-Horn Hann, and Lorin M. Hitt. 2002. Price dispersion and differentiation in online travel: An empirical investigation. Management Science 48 (4): 534–549. https://doi.org/10.1287/mnsc.48.4.534. ArticleGoogle Scholar

- Cooper, William L., Tito Homem-de-Mello, and Anton J. Kleywegt. 2015. Learning and pricing with models that do not explicitly incorporate competition. Operations Research 63 (1): 86–103. https://doi.org/10.1287/opre.2014.1341. ArticleGoogle Scholar

- Currie, Christine S. M., Russell C. H. Cheng, and Honora K. Smith. 2008. Dynamic pricing of airline tickets with competition. Journal of the Operational Research Society 59 (8): 1026–1037. https://doi.org/10.1057/palgrave.jors.2602425. ArticleGoogle Scholar

- Dana, James D., and Nicholas C. Petruzzi. 2001. Note: The newsvendor model with endogenous demand. Management Science 47 (11): 1488–1497. https://doi.org/10.1287/mnsc.47.11.1488.10252. ArticleGoogle Scholar

- Dana, James D., and Kevin R. Williams. 2022. Intertemporal price discrimination in sequential quantity-price games. Marketing Science. https://doi.org/10.1287/mksc.2021.1345. ArticleGoogle Scholar

- Dasci, Abdullah, and Mustafa Karakul. 2009. Two-period dynamic versus fixed-ratio pricing in a capacity constrained duopoly. European Journal of Operational Research 197 (3): 945–968. https://doi.org/10.1016/j.ejor.2007.12.039. ArticleGoogle Scholar

- Dautzenberg, Kirsti, Constanze Gaßmann, and Britta Groß. 2018. Online-Handel: Das Spiel mit dem dynamischen Preis. https://www.verbraucherzentrale-brandenburg.de/sites/default/files/2018-08/marktwaechter-untersuchung-dynamische-preisdifferenzierung.pdf. Accessed 14 March 2022.

- Davidkhanian, Suzy. 2021. US retail spending jumped nearly 16% this year despite inflation, supply chain woes. https://www.emarketer.com/content/us-retail-spending-jumped-this-year-despite-inflation-supply-chain-woes. Accessed 14 March 2022.

- de Toni, Deonir, Gabriel Sperandio Milan, Evandro Busata Saciloto, and Fabiano Larentis. 2017. Pricing strategies and levels and their impact on corporate profitability. Revista de Administração 52 (2): 120–133. https://doi.org/10.1016/j.rausp.2016.12.004. ArticleGoogle Scholar

- Deck, Cary, and Gu Jingping. 2012. Price increasing competition? Experimental evidence. Journal of Economic Behavior & Organization 84 (3): 730–740. https://doi.org/10.1016/j.jebo.2012.09.015. ArticleGoogle Scholar

- den Boer, Arnoud V. 2015a. Dynamic pricing and learning: Historical origins, current research, and new directions. Surveys in Operations Research and Management Science 20 (1): 1–18. https://doi.org/10.1016/j.sorms.2015.03.001. ArticleGoogle Scholar

- den Boer, Arnoud V. 2015b. Tracking the market: Dynamic pricing and learning in a changing environment. European Journal of Operational Research 247 (3): 914–927. ArticleGoogle Scholar

- DeSarbo, Wayne S., and Rajdeep Grewal. 2007. An alternative efficient representation of demand-based competitive asymmetry. Strategic Management Journal 28 (7): 755–766. https://doi.org/10.1002/smj.601. ArticleGoogle Scholar

- Devaraj, Sarv, Ming Fan, and Rajiv Kohli. 2002. Antecedents of B2C channel satisfaction and preference: Validating e-commerce metrics. Information Systems Research 13 (3): 316–333. https://doi.org/10.1287/isre.13.3.316.77. ArticleGoogle Scholar

- Diamond, Peter A. 1971. A model of price adjustment. Journal of Economic Theory 3 (2): 156–168. https://doi.org/10.1016/0022-0531(71)90013-5. ArticleGoogle Scholar

- Dickson, Peter R., and Joel E. Urbany. 1994. Retailer reactions to competitive price changes. Journal of Retailing 70 (1): 1–21. https://doi.org/10.1016/0022-4359(94)90025-6. ArticleGoogle Scholar

- Dinerstein, Michael, Liran Einav, Jonathan Levin, and Neel Sundaresan. 2018. Consumer price search and platform design in internet commerce. American Economic Review 108 (7): 1820–1859. https://doi.org/10.1257/aer.20171218. ArticleGoogle Scholar

- Dong, James, A. Serdar Simsek, and Huseyin Topaloglu. 2019. Pricing problems under the Markov chain choice model. Production and Operations Management 28 (1): 157–175. https://doi.org/10.1111/poms.12903. ArticleGoogle Scholar

- Dudey, Marc. 1992. Dynamic Edgeworth-Bertrand competition. Quarterly Journal of Economics 107 (4): 1461–1477. https://doi.org/10.2307/2118397. ArticleGoogle Scholar

- Dzyabura, Daria, Srikanth Jagabathula, and Eitan Muller. 2019. Accounting for discrepancies between online and offline product evaluations. Marketing Science 38 (1): 88–106. https://doi.org/10.1287/mksc.2018.1124. ArticleGoogle Scholar

- Elmaghraby, Wedad, and Pınar Keskinocak. 2003. Dynamic pricing in the presence of inventory considerations: Research overview, current practices, and future directions. Management Science 49 (10): 1287–1309. https://doi.org/10.1287/mnsc.49.10.1287.17315. ArticleGoogle Scholar

- Farias, Vivek, Denis Saure, and Gabriel Y. Weintraub. 2012. An approximate dynamic programming approach to solving dynamic oligopoly models. RAND Journal of Economics 43 (2): 253–282. https://doi.org/10.1111/j.1756-2171.2012.00165.x. ArticleGoogle Scholar

- Fay, Scott. 2008. Selling an opaque product through an intermediary: The case of disguising one’s product. Journal of Retailing 84 (1): 59–75. https://doi.org/10.1016/j.jretai.2008.01.005. ArticleGoogle Scholar

- Federgruen, Awi, and Hu Ming. 2015. Multi-product price and assortment competition. Operations Research 63 (3): 572–584. https://doi.org/10.1287/opre.2015.1380. ArticleGoogle Scholar

- Ferreira, Kris Johnson, Bin Hong Alex. Lee, and David Simchi-Levi. 2016. Analytics for an online retailer: Demand forecasting and price optimization. Manufacturing Service Operations Management 18 (1): 69–88. https://doi.org/10.1287/msom.2015.0561. ArticleGoogle Scholar

- Fisher, Marshall, Santiago Gallino, and Jun Li. 2018. Competition-based dynamic pricing in online retailing: A methodology validated with field experiments. Management Science 64 (6): 2473–2972. https://doi.org/10.1287/mnsc.2017.2753. ArticleGoogle Scholar

- Frambach, Ruud T., Henk C.A. Roest, and Trichy V. Krishnan. 2007. The impact of consumer internet experience on channel preference and usage intentions across the different stages of the buying process. Journal of Interactive Marketing 21 (2): 26–41. https://doi.org/10.1002/dir.20079. ArticleGoogle Scholar

- Gallego, Guillermo, and Hu Ming. 2014. Dynamic pricing of perishable assets under competition. Management Science 60 (5): 1241–1259. https://doi.org/10.1287/mnsc.2013.1821. ArticleGoogle Scholar

- Gallego, Guillermo, Woonghee Tim Huh, Wanmo Kang, and Robert Phillips. 2006. Price competition with the attraction demand model: Existence of unique equilibrium and its stability. Manufacturing & Service Operations Management 8 (4): 359–375. https://doi.org/10.1287/msom.1060.0115. ArticleGoogle Scholar

- Gallego, Guillermo, and Garrett J. van Ryzin. 1997. A multiproduct dynamic pricing problem and its applications to network yield management. Operations Research 45 (1): 24–41. https://doi.org/10.1287/opre.45.1.24. ArticleGoogle Scholar

- Gallego, Guillermo, and Ruxian Wang. 2014. Multi-product optimization and competition under the nested logit model with product-differentiated price sensitivities. Operations Research 62 (2): 450–461. https://doi.org/10.1287/opre.2013.1249. ArticleGoogle Scholar

- Gao, Fei, and Su Xuanming. 2018. Omnichannel service operations with online and offline self-order technologies. Management Science 64 (8): 3595–3608. https://doi.org/10.1287/mnsc.2017.2787. ArticleGoogle Scholar

- Geng, Qin, and Suman Mallik. 2007. Inventory competition and allocation in a multi-channel distribution system. European Journal of Operational Research 182 (2): 704–729. https://doi.org/10.1016/j.ejor.2006.08.041. ArticleGoogle Scholar

- Gönsch, Jochen, Robert Klein, and Claudius Steinhardt. 2009. Dynamic pricing - State-of-the-art. Journal of Business Economics 3 (2): 1–40. Google Scholar

- Gupta, Varun, Dmitry Ivanov, and Tsan-Ming Choi. 2021. Competitive pricing of substitute products under supply disruption. Omega. https://doi.org/10.1016/j.omega.2020.102279. ArticleGoogle Scholar

- Hagiu, Andrei. 2007. Merchant or two-sided platform? Review of Network Economics 6 (2): 115–133. https://doi.org/10.2202/1446-9022.1113. ArticleGoogle Scholar

- Hall, Joseph M., Praveen K. Kopalle, and David F. Pyke. 2009. Static and dynamic pricing of excess capacity in a make-to-order environment. Production and Operations Management 18 (4): 411–425. https://doi.org/10.1111/j.1937-5956.2009.01044.x. ArticleGoogle Scholar

- Hamilton, Jonathan H., and Steven M. Slutsky. 1990. Endogenous timing in duopoly games: Stackelberg or cournot equilibria. Games and Economic Behavior 2 (1): 29–46. https://doi.org/10.1016/0899-8256(90)90012-J. ArticleGoogle Scholar

- Harsha, Pavithra, Shivaram Subramanian, and Joline Uichanco. 2019. Dynamic pricing of omnichannel inventories. Manufacturing & Service Operations Management 21 (1): 47–65. https://doi.org/10.1287/msom.2018.0737. ArticleGoogle Scholar

- Heese, H. Sebastian, and Victor Martínez-de-Albéniz. 2018. Effects of assortment breadth announcements on manufacturer competition. Manufacturing and Service Operations Management 20 (2): 302–316. https://doi.org/10.1287/msom.2017.0643. ArticleGoogle Scholar

- Hinterhuber, Andreas. 2008. Customer value-based pricing strategies: Why companies resist. Journal of Business Strategy 29 (4): 41–50. https://doi.org/10.1108/02756660810887079. ArticleGoogle Scholar

- Isler, Karl, and Henrik Imhof. 2008. A game theoretic model for airline revenue management and competitive pricing. Journal of Revenue and Pricing Management 7 (4): 384–396. https://doi.org/10.1057/rpm.2008.30 . ArticleGoogle Scholar

- Israeli, Ayelet, Fiona Scott-Morton, Jorge Silva-Risso, and Florian Zettelmeyer. 2022. How market power affects dynamic pricing: Evidence from inventory fluctuations at car dealerships. Management Science 68 (2): 895–916. https://doi.org/10.1287/mnsc.2021.3967. ArticleGoogle Scholar

- Ittoo, Ashwin, and Nicolas Petit. 2017. Algorithmic pricing agents and tacit collusion: A technological perspective. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.3046405. ArticleGoogle Scholar

- Janssen, Maarten C. W., and José Luis Moraga-González. 2004. Strategic pricing, consumer search and the number of firms. Review of Economic Studies 71 (4): 1089–1118. https://doi.org/10.1111/0034-6527.00315. ArticleGoogle Scholar

- Jerath, Kinshuk, Serguei Netessine, and Senthil K. Veeraraghavan. 2010. Revenue management with strategic customers: Last-minute selling and opaque selling. Management Science 56 (3): 430–448. https://doi.org/10.1287/mnsc.1090.1125. ArticleGoogle Scholar

- Kachani, Shmatov, Soulaymane Kachani, and Kyrylo Shmatov. 2010. Competitive pricing in a multi-product multi-attribute environment. Production and Operations Management 20 (5): 668–680. https://doi.org/10.1111/j.1937-5956.2010.01195.x. ArticleGoogle Scholar

- Kastius, Alexander, and Rainer Schlosser. 2022. Dynamic pricing under competition using reinforcement learning. Journal of Revenue and Pricing Management 21 (1): 50–63. https://doi.org/10.1057/s41272-021-00285-3. ArticleGoogle Scholar

- Keskin, N. Bora, and Assaf Zeevi. 2017. Chasing demand: Learning and earning in a changing environment. Mathematics of Operations Research 42 (2): 277–307. https://doi.org/10.1287/moor.2016.0807. ArticleGoogle Scholar

- Kim, Jun B., Paulo Albuquerque, and Bart J. Bronnenberg. 2011. Mapping online consumer search. Journal of Marketing Research 48 (1): 13–27. https://doi.org/10.1509/jmkr.48.1.13. ArticleGoogle Scholar

- Koças, Cenk. 2005. A model of internet pricing under price-comparison shopping. International Journal of Electronic Commerce 10 (1): 111–134. https://doi.org/10.1080/10864415.2005.11043959. ArticleGoogle Scholar

- Könönen, Ville. 2006. Dynamic pricing based on asymmetric multiagent reinforcement learning. International Journal of Intelligent Systems 21 (1): 73–98. https://doi.org/10.1002/int.20121. ArticleGoogle Scholar

- Kopalle, Praveen, Dipayan Biswas, Pradeep K. Chintagunta, Jia Fan, Koen Pauwels, Brian T. Ratchford, and James A. Sills. 2009. Retailer pricing and competitive effects. Journal of Retailing 85 (1): 56–70. https://doi.org/10.1016/j.jretai.2008.11.005. ArticleGoogle Scholar

- Kutschinski, Erich, Thomas Uthmann, and Daniel Polani. 2003. Learning competitive pricing strategies by multi-agent reinforcement learning. Journal of Economic Dynamics and Control 27 (11): 2207–2218. https://doi.org/10.1016/S0165-1889(02)00122-7. ArticleGoogle Scholar

- Lal, Rajiv, and Ram Rao. 1997. Supermarket competition: The case of every day low pricing. Marketing Science 16 (1): 60–80. https://doi.org/10.1287/mksc.16.1.60. ArticleGoogle Scholar

- Lal, Rajiv, and Miklos Sarvary. 1999. When and how is the internet likely to decrease price competition? Marketing Science 18 (4): 485–503. https://doi.org/10.1287/mksc.18.4.485. ArticleGoogle Scholar

- Lancaster, Kelvin. 1979. Variety, equity, and efficiency: Product variety in an industrial society. New York: Columbia University Press. BookGoogle Scholar

- Larson, Ronald B. 2019. Promoting demand-based pricing. Journal of Revenue and Pricing Management 18 (1): 42–51. https://doi.org/10.1057/s41272-017-0126-9. ArticleGoogle Scholar

- Le Chen, Alan Mislove, and Christo Wilson. 2016. An empirical analysis of algorithmic pricing on Amazon Marketplace. In Proceedings of the 25th International Conference on World Wide Web - WWW '16, 1339–1349, Montreal. 11-Apr-16 - 15-Apr-16. New York: ACM Press. https://doi.org/10.1145/2872427.2883089

- Lebow, Sara. 2019. Worldwide ecommerce continues double-digit growth following pandemic push to online. https://www.emarketer.com/content/worldwide-ecommerce-continues-double-digit-growth-following-pandemic-push-online. Accessed 14 March 2022.

- Lee, Khai Sheang, and Soo Jiuan Tan. 2003. E-retailing versus physical retailing. A theoretical model and empirical test of consumer choice. Journal of Business Research 56 (11): 877–885. https://doi.org/10.1016/S0148-2963(01)00274-0. ArticleGoogle Scholar

- Lee, Thomas Y., and Eric T. Bradlow. 2011. Automated marketing research using online customer reviews. Journal of Marketing Research 48 (5): 881–894. https://doi.org/10.1509/jmkr.48.5.881. ArticleGoogle Scholar

- Levin, Yuri, Jeff McGill, and Mikhail Nediak. 2008. Risk in revenue management and dynamic pricing. Operations Research 56 (2): 326–343. https://doi.org/10.1287/opre.1070.0438. ArticleGoogle Scholar

- Levin, Yuri, Jeff McGill, and Mikhail Nediak. 2009. Dynamic pricing in the presence of strategic consumers and oligopolistic competition. Management Science 55: 32–46. https://doi.org/10.1287/mnsc.1080.0936. ArticleGoogle Scholar

- Li, Jun, Serguei Netessine, and Sergei Koulayev. 2017. Price to compete… with many: How to identify price competition in high-dimensional space. Management Science 64 (9): 4118–4136. https://doi.org/10.1287/mnsc.2017.2820. ArticleGoogle Scholar

- Li, Michael Z. F., Anming Zhang, and Yimin Zhang. 2008. Airline seat allocation competition. International Transactions in Operational Research 15 (4): 439–459. https://doi.org/10.1111/j.1475-3995.2008.00642.x. ArticleGoogle Scholar

- Lin, Yen-Ting, Ali K. Parlaktürk, and Jayashankar M. Swaminathan. 2014. Vertical integration under competition: Forward, backward, or no integration? Production and Operations Management 23 (1): 19–35. https://doi.org/10.1111/poms.12030. ArticleGoogle Scholar

- Lin, Kyle Y., and Soheil Y. Sibdari. 2009. Dynamic price competition with discrete customer choices. European Journal of Operational Research 197 (3): 969–980. https://doi.org/10.1016/j.ejor.2007.12.040. ArticleGoogle Scholar

- Liozu, Stephan. 2015. The pricing journey: The organizational transformation toward pricing excellence. Stanford: Stanford Business Books. BookGoogle Scholar

- Lippman, Steven A., and Kevin F. McCardle. 1997. The competitive newsboy. Operations Research 45 (1): 54–65. https://doi.org/10.1287/opre.45.1.54. ArticleGoogle Scholar

- Liu, Qian, and Dan Zhang. 2013. Dynamic pricing competition with strategic customers under vertical product differentiation. Management Science 59 (1): 84–101. https://doi.org/10.1287/mnsc.1120.1564. ArticleGoogle Scholar

- Loginova, Oksana. 2021. Price competition online: Platforms versus branded websites. Journal of Economics and Management Strategy. https://doi.org/10.1111/jems.12461. ArticleGoogle Scholar

- Mantin, Benny, Daniel Granot, and Frieda Granot. 2011. Dynamic pricing under first order Markovian competition. Naval Research Logistics 58 (6): 608–617. https://doi.org/10.1002/nav.20470. ArticleGoogle Scholar

- Martínez-de-Albéniz, Victor, and Kalyan Talluri. 2011. Dynamic price competition with fixed capacities. Management Science 57 (6): 1078–1093. https://doi.org/10.1287/mnsc.1110.1337. ArticleGoogle Scholar

- Maskin, Eric, and Jean Tirole. 1988. A theory of dynamic oligopoly, II: Price competition, kinked demand curves, and edgeworth cycles. Econometrica 56 (3): 571–599. https://doi.org/10.2307/1911701. ArticleGoogle Scholar

- Matsubayashi, Nobuo, and Yoshiyasu Yamada. 2008. A note on price and quality competition between asymmetric firms. European Journal of Operational Research 187 (2): 571–581. https://doi.org/10.1016/j.ejor.2007.03.021. ArticleGoogle Scholar

- McGill, Jeffrey I., and Garrett J. van Ryzin. 1999. Revenue management: Research overview and prospects. Transportation Science 33 (2): 233–256. https://doi.org/10.1287/trsc.33.2.233. ArticleGoogle Scholar

- Miklós-Thal, Jeanine, and Catherine Tucker. 2019. Collusion by algorithm: Does better demand prediction facilitate coordination between sellers? Management Science 65 (4): 1552–1561. https://doi.org/10.1287/mnsc.2019.3287. ArticleGoogle Scholar

- Mitra, Subrata. 2021. Economic models of price competition between traditional and online retailing under showrooming. Decision. https://doi.org/10.1007/s40622-021-00293-7. ArticleGoogle Scholar

- Mizuno, Toshihide. 2003. On the existence of a unique price equilibrium for models of product differentiation. International Journal of Industrial Organization 21 (6): 761–793. https://doi.org/10.1016/S0167-7187(03)00017-1. ArticleGoogle Scholar

- Mookherjee, Reetabrata, and Terry L. Friesz. 2008. Pricing, allocation, and overbooking in dynamic service network competition when demand is uncertain. Production and Operations Management 17 (4): 455–474. https://doi.org/10.3401/poms.1080.0042. ArticleGoogle Scholar

- Moorthy, K. Sridhar. 1988. Product and price competition in a duopoly. Marketing Science 7 (2): 141–168. https://doi.org/10.1287/mksc.7.2.141. ArticleGoogle Scholar

- Motta, Massimo. 1993. Endogenous quality choice: Price vs. quantity competition. The Journal of Industrial Economics 41 (2): 113–131. https://doi.org/10.2307/2950431. ArticleGoogle Scholar

- Nalca, Arcan, Tamer Boyaci, and Saibal Ray. 2010. Competitive price-matching guarantees under imperfect store availability. Quantitative Marketing and Economics 8 (3): 275–300. https://doi.org/10.1007/s11129-010-9080-1. ArticleGoogle Scholar

- Netessine, Serguei, and Robert A. Shumsky. 2005. Revenue management games: Horizontal and vertical competition. Management Science 51 (5): 813–831. https://doi.org/10.1287/mnsc.1040.0356. ArticleGoogle Scholar

- Netzer, Oded, Ronen Feldman, Jacob Goldenberg, and Moshe Fresko. 2012. Mine your own business: Market-structure surveillance through text mining. Marketing Science 31 (3): 521–543. https://doi.org/10.1287/mksc.1120.0713. ArticleGoogle Scholar

- Nip, Kameng, Changjun Wang, and Zizhuo Wang. 2020. Competitive and cooperative assortment games under Markov chain choice model. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.3607722. ArticleGoogle Scholar

- Noel, Michael D. 2007. Edgeworth price cycles, cost-based pricing, and sticky pricing in retail gasoline markets. Review of Economics and Statistics 89 (2): 324–334. https://doi.org/10.1162/rest.89.2.324. ArticleGoogle Scholar

- Obermeyer, Andy, Christos Evangelinos, and Ronny Püschel. 2013. Price dispersion and competition in European airline markets. Journal of Air Transport Management 26 (1): 31–34. https://doi.org/10.1016/j.jairtraman.2012.08.014. ArticleGoogle Scholar

- Olivares, Marcelo, and Gérard. P. Cachon. 2009. Competing retailers and inventory: An empirical investigation of General Motors’ dealerships in isolated U.S. markets. Management Science 55 (9): 1586–1604. https://doi.org/10.1287/mnsc.1090.1050. ArticleGoogle Scholar

- Parlar, Mahmut. 1988. Game theoretic analysis of the substitutable product inventory problem with random demands. Naval Research Logistics 35 (3): 397–409. https://doi.org/10.1002/1520-6750(198806)35:3%3c397:AID-NAV3220350308%3e3.0.CO;2-Z. ArticleGoogle Scholar

- Penz, Elfriede, and Margaret K. Hogg. 2011. The role of mixed emotions in consumer behaviour. European Journal of Marketing 45 (1): 104–132. https://doi.org/10.1108/03090561111095612. ArticleGoogle Scholar

- Perakis, Georgia, and Anshul Sood. 2006. Competitive multi-period pricing for perishable products: A robust optimization approach. Mathematical Programming 107 (1–2): 295–335. https://doi.org/10.1007/s10107-005-0688-y. ArticleGoogle Scholar

- Perloff, Jeffrey M., and Steven C. Salop. 1985. Equilibrium with product differentiation. Review of Economic Studies 52 (1): 107. https://doi.org/10.2307/2297473. ArticleGoogle Scholar

- Phillips, Robert L. 2021. Pricing and revenue optimization, 2nd ed. Stanford: Stanford Business Books. BookGoogle Scholar

- Pigou, Arthur Cecil. 1920. The economics of welfare. London: Macmillan & co. Google Scholar

- Popescu, Dana. 2015. Repricing algorithms in e-commerce. Technology and Operations Management (Working Paper No. 2015/75/TOM). https://doi.org/10.2139/ssrn.2669997.

- Putsis, William, and Ravi Dhar. 1998. The many faces of competition. Marketing Letters 9 (3): 269–284. https://doi.org/10.1023/A:1008072222645. ArticleGoogle Scholar

- Ratchford, Brian T. 2009. Online pricing: Review and directions for research. Journal of Interactive Marketing 23 (1): 82–90. https://doi.org/10.1016/j.intmar.2008.11.001. ArticleGoogle Scholar

- Richards, Timothy J., and Stephen F. Hamilton. 2006. Rivalry in price and variety among supermarket retailers. American Journal of Agricultural Economics 88 (3): 710–726. https://doi.org/10.1111/j.1467-8276.2006.00890.x. ArticleGoogle Scholar

- Ringel, Daniel M., and Bernd Skiera. 2016. Visualizing asymmetric competition among more than 1,000 products using big search data. Marketing Science 35 (3): 511–534. https://doi.org/10.1287/mksc.2015.0950. ArticleGoogle Scholar

- Ryan, Jennifer K., Daewon Sun, and Xuying Zhao. 2012. Competition and coordination in online marketplaces. Production and Operations Management 21 (6): 997–1014. https://doi.org/10.1111/j.1937-5956.2012.01332.x. ArticleGoogle Scholar

- Salop, Steven C. 1976. Information and monopolistic competition. American Economic Review 66 (2): 240–245. Google Scholar

- Sarkar, Amit, and Brojeswar Pal. 2021. Competitive pricing strategies of multi channel supply chain under direct servicing by the manufacturer. RAIRO Operations Research 55 (1): 1849–1873. https://doi.org/10.1051/ro/2020063. ArticleGoogle Scholar

- Scarpi, Daniele, Gabriele Pizzi, and Marco Visentin. 2014. Shopping for fun or shopping to buy: Is it different online and offline? Journal of Retailing and Consumer Services 21 (3): 258–267. https://doi.org/10.1016/j.jretconser.2014.02.007. ArticleGoogle Scholar

- Schinkel, Maarten Pieter, Jan Tuinstra, and Dries Vermeulen. 2002. Convergence of Bayesian learning to general equilibrium in mis-specified models. Journal of Mathematical Economics 38 (4): 483–508. https://doi.org/10.1016/S0304-4068(02)00062-9. ArticleGoogle Scholar

- Schlereth, Christian, Bernd Skiera, and Fabian Schulz. 2018. Why do consumers prefer static instead of dynamic pricing plans? An empirical study for a better understanding of the low preferences for time-variant pricing plans. European Journal of Operational Research 269 (3): 1165–1179. https://doi.org/10.1016/j.ejor.2018.03.033. ArticleGoogle Scholar

- Schlosser, Rainer, and Martin Boissier. 2018. Dealing with the dimensionality curse in dynamic pricing competition: Using frequent repricing to compensate imperfect market anticipations. Computers and Operations Research 100: 26–42. https://doi.org/10.1016/j.cor.2018.07.011. ArticleGoogle Scholar

- Schlosser, Rainer, Martin Boissier, Andre Schober, and Matthias Uflacker. 2016. How to survive dynamic pricing competition in e-commerce. In Proceedings of the 10th ACM conference on recommender systems, Boston. 15-Sept-16 to 19-Sept-16. New York: Association for Computing Machinery.

- Schlosser, Rainer, and Keven Richly. 2019. Dynamic pricing under competition with data-driven price anticipations and endogenous reference price effects. Journal of Revenue and Pricing Management 18: 451–464. https://doi.org/10.1057/s41272-019-00206-5. ArticleGoogle Scholar

- Serth, Sebastian, Nikolai Podlesney, Marvin Bornstein, Jan Lindemann, Johanna Lattt, Jan Selke, Rainer Schlosser, Martin Boissier, and Matthias Uflacker. 2017. An interactive platform to simulate dynamic pricing competition on online marketplaces. In IEEE 21st International Enterprise Distributed Object Computing Conference, 61–66, Quebec City, Canada. 10-Oct-17 to 13-Oct-17. https://doi.org/10.1109/EDOC.2017.17.

- Shugan, Steven M. 2002. Editorial: Marketing science, models, monopoly models, and why we need them. Marketing Science 21 (3): 223–228. https://doi.org/10.1287/mksc.21.3.223.145. ArticleGoogle Scholar

- Siegert, Caspar, and Robert Ulbricht. 2020. Dynamic oligopoly pricing: Evidence from the airline industry. International Journal of Industrial Organization 71: 102639. https://doi.org/10.1016/j.ijindorg.2020.102639. ArticleGoogle Scholar

- Simon, Hermann. 1979. Dynamics of price elasticity and brand life cycles: An empirical study. Journal of Marketing Research 16 (4): 439–452. https://doi.org/10.1177/002224377901600401. ArticleGoogle Scholar